How an HSA Can Help

Planning for Health Care Costs in Retirement: Why It Matters and How an HSA Can Help

Health care is one of the biggest and most underestimated expenses in retirement. As people live longer and medical costs continue to rise, Medicare alone isn’t enough—leaving retirees to cover premiums, co-pays, and out-of-pocket expenses. Without a solid plan, these costs can quickly drain your savings and create financial stress.

Talking about aging and health care isn’t always easy, but avoiding the conversation can lead to costly surprises. A smart strategy helps you stay prepared, giving you peace of mind and financial security. Your future medical costs will depend on factors like your health, lifestyle, and even where you live, and with longer life expectancy, these expenses could last for decades.

Because health care costs are unpredictable and rising, planning is more important than ever. Taking steps now can help protect your savings, maintain your quality of life, and give you confidence in your financial future.

Why an HSA is One of the Smartest Ways to Save

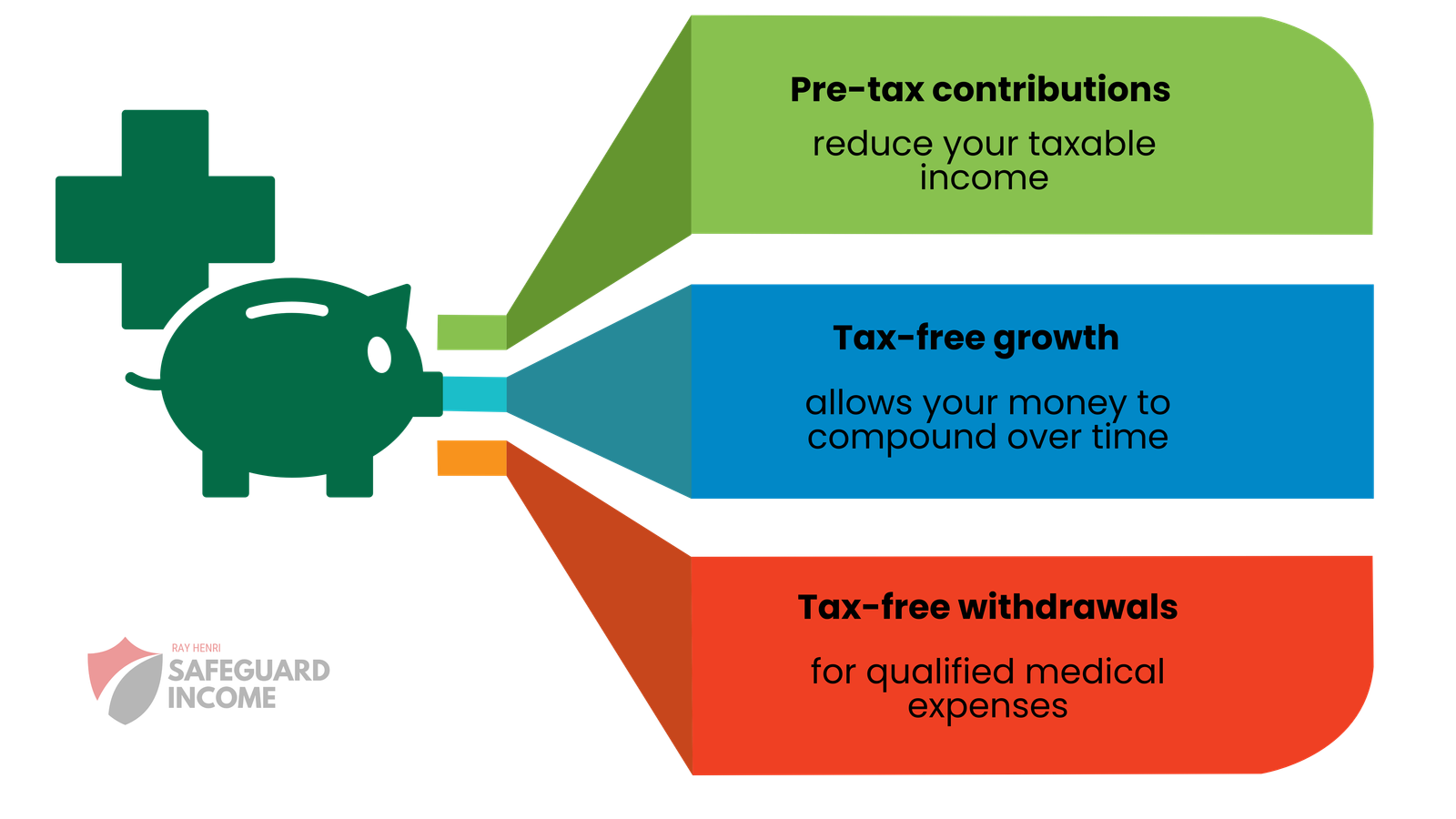

A Health Savings Account (HSA) is one of the best tools to prepare for medical costs in retirement. It offers a triple tax advantage:

- Pre-tax contributions reduce your taxable income

- Tax-free growth allows your money to compound over time

- Tax-free withdrawals for qualified medical expenses

This makes an HSA a powerful way to lower your tax bill today while preparing for health care costs tomorrow.

As you near retirement, an HSA becomes even more valuable. High earners can reduce their tax liability, while retirees can cover medical expenses 100% tax-free.

For example, if you have $5,000 in medical bills, you can withdraw that amount from your HSA with zero tax. In 2025, the maximum contribution is $4,300 for individuals and $8,550 for families. If you’re 55 or older, you can contribute an extra $1,000, giving you even more tax-free savings.

If you’re married and filing jointly in your 60s, you and your spouse can maximize contributions. Either spouse can open an HSA, but to make the most of it, each should have their own account. A couple over 55 can contribute a combined total of $9,550 tax-free.

Important Things to Know

- Once you enroll in Medicare, you can no longer contribute to an HSA. To take full advantage, start saving before retirement.

- Non-medical withdrawals before age 65 incur income tax and a 20% penalty. After 65, non-medical withdrawals are taxed as regular income but avoid the penalty.

- The Employee Benefit Research Institute (EBRI)estimates that 90% of women over 65 will need at least $217,000 for medical expenses, while men will need $184,000.

With rising health care costs and longer retirement periods, having a dedicated, tax-free fund for medical expenses is essential.

It’s no surprise that an HSA is often called a “Medical IRA”—a smart way to build tax-free income for retirement while protecting your financial future.

The best time to start is now.

Every dollar you save today helps secure your health and financial well-being for the future. Don’t wait—start contributing to your HSA and take control of your retirement health care costs. Contact Now!