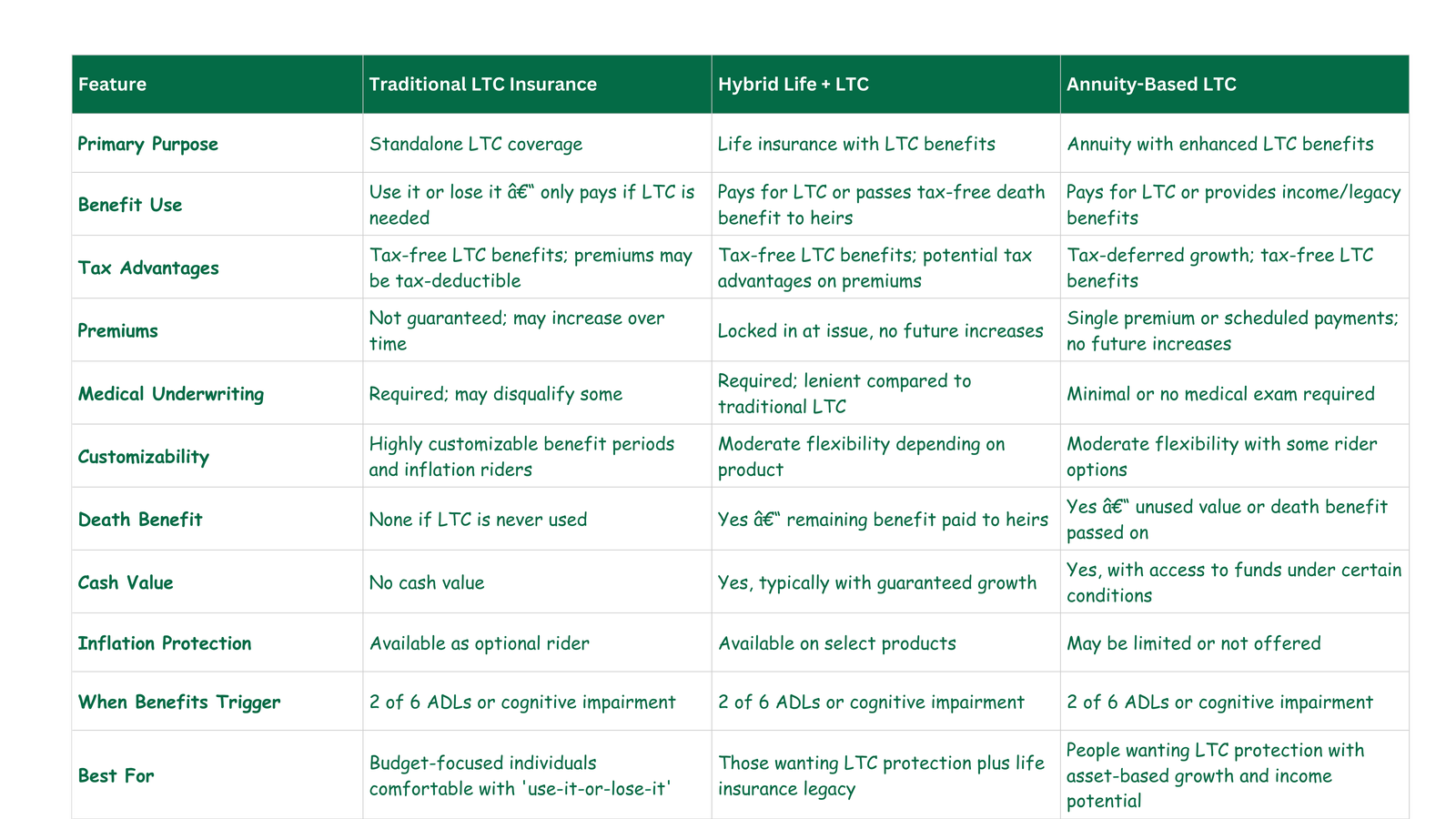

Compare your long term care planning options

When it comes to preparing for long-term care, it’s essential to find a solution that aligns with your financial situation, health, and future goals. Here’s a breakdown of the key points from the comparison of Traditional LTC Insurance, Hybrid Life + LTC, and Annuity-Based LTC options:

Traditional LTC Insurance:

This is a straightforward option that provides standalone coverage for long-term care needs. It’s ideal for those who are comfortable with a “use-it-or-lose-it” approach. While premiums may increase over time, the tax advantages are clear, and it offers dedicated coverage for long-term care. If you’re on a budget but want solid LTC coverage, this is a good option.

Hybrid Life + LTC:

A great choice for individuals who want both long-term care protection and a life insurance legacy. This option offers peace of mind, as any remaining benefits can be passed on to heirs. Premiums are locked in at the time of purchase, meaning no surprise hikes later. It’s best for those looking for a balance of care coverage and leaving something behind for their loved ones.

Annuity-Based LTC:

If you’re interested in both income potential and long-term care protection, this option allows you to build wealth while ensuring coverage for future care needs. With minimal or no medical exams required, it’s ideal for those who want tax-deferred growth and the possibility of accessing funds under certain conditions.

Choosing the right option!

Choosing the right long-term care option is a personal decision that can impact your financial well-being in the future. Let’s discuss your options in more detail and find the best solution for you.

Schedule a free consultation today to explore how we can tailor a long-term care plan that fits your goals and lifestyle.

Contact Us to get started today.